TIP Academy

WARREN BUFFETT

BIOGRAPHY

Warren Buffett is a famous American investor who’s worth over 100 billion dollars. He attributes his ability to accumulate so much wealth to his mentor and Columbia College Professor, Benjamin Graham. Warren claims that Graham’s books, The Intelligent Investor and Security Analysis, are the primary sources of learning that he continues to reference even today. Buffett’s the third wealthiest person in the world. He’s the owner and CEO of Berkshire Hathaway and he has pledged to give away 99 percent of his wealth to charity upon death.

While it is true that Warren Buffett has become a very successful investor in today’s society, he has actually invested in many things throughout his life. His desire to be an investor started in childhood. That desire has never truly gone away at any point in his life.

Born in Omaha in 1930, Buffett was the son of a member of the United States House of Representatives. He worked at a grocery store run by one of his relatives for a good period of time. He even sold assorted products as a door to door salesman.

He used some of the money that he earned to fund a bank account. He also used some of his money to buy different items that he could invest in with the intention of earning money. One of the most notable examples came from how he bought a pinball machine to place in a public spot in town. He eventually used the money from that venture to buy more pinball machines to place in more spots so he could earn even more money.

In fact, Buffett even invested in shares while growing up. He bought three shares in Cities Services Preferred when he was eleven. He had a minor profit in his investment but sold his shares before they experienced massive price increases.

It is estimated that he had earned about five thousand dollars from his work when he graduated from high school. He did not have an interest in going to college but he did anyway, spending two years at the University of Pennsylvania’s Wharton Business School and then two years at the University of Nebraska at Lincoln.

Part of his education came from a major influence in his life. This influence came from Ben Graham, a prominent investor who created the concept of intrinsic business value. This refers to how the real worth of a business is often separate from the stock value that comes with it. His belief was that intrinsic value could be used to guide decisions in investments rather than stock numbers. This was a critical point of Buffett’s development in terms of how he was able to get into so many different investments after a while.

Buffett went to the Columbia Business School after graduating from Nebraska. He went to Columbia after hearing that Graham taught there. Interestingly enough, this came not too long after Buffett had tried to get into the Harvard Business School. He was rejected from Harvard because admissions assumed he was too young to attend it.

Buffett had studied many of Graham’s works including the Intelligent Investor, a book that Buffett continues to herald to this day as a book that was critical to his education as an investor. It includes one of the most important analogies that Buffett continues to follow to this very day in his investments.

Part of this education from Graham included his support of a value about investing that Graham introduced in this book. His Mr. Market analogy states that stock quotes are simply quotes given out by a business partner that is often going to keep on trying to sell stock and will keep on doing so until the point where that stock ends up being lower in value than what was originally offered or what the business in question might actually be worth.

The final part of Buffett’s education came from a visit with Lormier Davidson, the financial vice president of Geico in the late 1940s. Buffett went to the Geico offices in the hopes of meeting Graham because he was the chairman of that company at the time. However, Graham was not there but Buffett was able to talk with Davidson for several hours about business practices, how to find a profitable group and what a company should do in order to be more successful. This is a critical part of Buffett’s education. Ironically enough, Geico would be a part of Buffett’s business career thanks to how he bought out that company.

Buffett and Graham

The business career of Warren Buffett started out relatively small in the early 1950s but this was primarily from Buffett’s lesson in patience with investing after his early experience with Cities Services Preferred. He started out by buying a small Sinclair Texaco station in the area while he was working as a night class professor at the University of Nebraska in Omaha. He did not make any money off of his Sinclair Texaco investment. He eventually received a call from Graham asking if he was interested in working for him. He eventually got into a partnership with Graham. However, Buffett had some differences between him and Graham. Buffett was more interested in seeing how a company manages itself and how it might be better than other companies when thinking about who to invest in. This is different from the emphasis on numbers that Graham had been using.

Buffett’s money would eventually grow while working alongside Graham. It got to the point where Buffett had made more than $100,000 from 1950 to 1956. This was much higher than the nearly $10,000 that he had at the start of that time. The amount of time Buffett spent with Graham was relatively limited though. Graham tended to focus on hiring Jewish people who were not being taken in by organizations that were Gentile-based. This prompted Buffett, who is not Jewish, to go elsewhere.

How Buffett Became a Millionaire

Buffett created Buffett Associates, Ltd. in 1956. He did this with a few other partners with his sister and aunt being among those people who got in on it. The group was dedicated to work towards investing in shares with businesses in a responsible manner. He was able to get a few partnerships with some businesses during this time and eventually got to where he had nearly $300,000 in capital around the end of that year. The partnership of Buffett Associates, Ltd. helped make Buffett a millionaire in 1962. Nearly a million dollars of the $7 million that the partnership had came out of his money.

Berkshire Hathaway

It would not be long until Buffett bought Berkshire Hathaway, a textile company. He also met Charlie Munger around this time. Munger was a lawyer who eventually focused on investments and has become a quick friend of Buffett. Today Munger continues to work alongside Buffett at Berkshire Hathaway.

Buffett’s first private business investment came in 1966. He invested in a department store in the Baltimore area. Buffett continues to invest in varying stocks and commodities. His efforts with Berkshire Hathaway eventually became more noticeable among investors to the point where times when he would end up investing in something were often signs that something of use was more interesting and potentially more likely to be profitable over time. It eventually got to the point where Buffett had a net worth of a little over half a billion dollars by the end of the 1970s.

However, Buffett was not always successful in his business career. One example involves how he lost a good deal of money in his investment of the Buffalo Evening News newspaper. This came from an antitrust case that was started by that paper’s rival, the Buffalo Courier-Express. However, Buffett continues to hold ownership in the Buffalo News. In this interview, Warren Buffett also shared some of his investing mistakes.

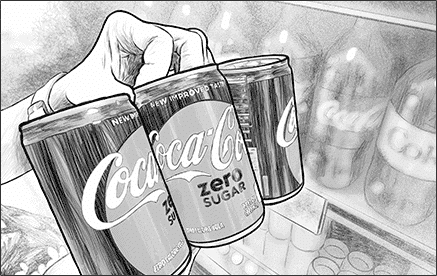

There was also the concern about a market correction in 1987. This caused nearly a quarter of Buffett’s value to be wiped out. However, he rebounded in 1988 by buying up shares of Coca-Cola. He eventually got to the point where the shares that he owned would be close to a billion dollars in value.

How Buffett Became a Billionaire

In 1990 Berkshire Hathaway started to sell class A shares. The shares were around $7,000 each at the time, thus helping to get Buffett to technically become a billionaire. Buffett had a very minimal increase in his assets in 1999, thus leading people to fear that he was losing his touch and that he could be a victim of his own investments. However, he focused on intrinsic value and invested in businesses that were selling shares below their intrinsic values. This helped him to keep on moving ahead and to avoid the pains that came with the technology bubble bursting around that time.

He had invested in a series of banks in recent years. He has spent some money on Wells Fargo and has experienced very mixed results with Goldman Sachs and Bank of America. His results in his investments have involved some losses due to the financial crisis that have harmed the banking industry over the last couple of years.

Today Warren Buffett has gotten to where his Berkshire Hathaway company has revenues of about $140 billion a year. Berkshire Hathaway owns a number of notable companies. The companies that Buffett is an owner of include Benjamin Moore, Dairy Queen, Fruit of the Loom, Geico, Helzburg Diamonds, the Omaha World-Herald, Shaw Industries and Wesco Financial Corporation.

Buffett also continues to hold strong minority holdings in many notable businesses. He has a little less than ten percent of ownership in Coca-Cola. He has been involved with the company since the later part of the 1980s. Buffett also owns close to fifteen percent of American Express, M&T Bank and the Washington Post Company. Buffett most recently acquired a five percent stake in IBM in 2012.

Buffett’s influence has even gone so far as to impact discussions on taxes in the United States. This includes his concern about how he and other people who are rich tend to pay less of their money in taxes than people who don’t make as much money.

He currently has a net worth of about $91.6 billion. This makes him second to Bill Gates among the richest people in the world. In fact, Buffett has been working towards helping to support varying charitable organizations over the years with him donating many of his stocks to the Bill and Melinda Gates Foundation.

The opinions that Warren Buffett holds are interesting to find. They involve the ways how he feels about investing in a variety of different things. These include the ways how investments are to be handled and how different stock has to be used carefully to make it a little easier to run an investment plan the right way to potentially earn the most out of it.

Patience is a Virtue

Patience is often seen as a valuable point for Buffett to teach to people who want to invest like him. This includes observing the history of a business and considering its value to society and whether or not it is a business that may be viable to people in the future. It is used to make sure that an investor is aware of what can go on in society before ending up changing an investment. Of course, most of this could come from the experience that he had with Cities Service Preferred.

What Makes a Business Wonderful

Buffett also uses several criteria for finding the right businesses to use. These are referred to as “wonderful businesses” because they are businesses that might be more profitable and beneficial for people.

A key point that Buffett uses when finding “wonderful businesses” involves seeing how much of a return on capital is involved without any debt in mind. A business that has a smaller amount of debt on it is often seen as one that could be more successful over time.

There is also the interest in seeing how well earnings might work. Buffett feels that the best businesses are the ones that have earnings that are relatively predictable. Businesses like this might be safe but at the same time they may be used to help with figuring out what one might be able to get out of an investment.

One of the best parts of Buffett’s opinions on investing relates to how well businesses can run. He feels that the best businesses to invest in are the ones that are productive and meaningful to society. They should be companies that are actively making some kind of value to society that people can appreciate in. A business like this can be one that might be more active and more likely to be successful as it gets more involved with society in general.

Importance of Cash Flow

Another part of his investing strategies involves how he buys companies. He feels that cash flow streams have to be used carefully when finding investments. A business with a strong cash flow can be one that might be more interesting to invest in. In fact, cash flow streams are often used to determine whether or not he should go ahead with buying entire companies. This opinion of investing shows that he has a strong attachment to finding businesses that might be more profitable before actually buying those companies outright.

While it is true that the assets that Buffett has gotten into are diverse, he feels that diversification of a portfolio is not something that is always going to work out right. The problem with diversification is that it might involve trying to find businesses in random fields. The key is to focus on appropriate cash flows and beneficial investments even if this means finding options that are not always going to be very diverse in nature.

Forecasting and Predictability

One interesting opinion that Buffett has is that getting in on initial public offerings is never a good idea. This is due to how it might be too unpredictable to see how well an IPO is going to work. Buffett prefers to go along with investments that have proven themselves to be of some use in recent years.

Buffett also tries to avoid investing in online and social media companies. Although he does respect these companies, his opinion on investing in these companies is that it is too difficult for people to figure out whether or not stocks in this field will have decent values in the future. The lack of predictability and the lack of knowing how to forecast this point has been a part of the problem according to Buffett.

Buffett is not interested in investing in gold either. While he has gotten into other commodities in the past, he has plans to stay out of the gold picture for the foreseeable future. He feels that the gold industry is not something that is very productive.

Investing in an Easy-to-Run Business

Finally, Warren Buffett feels that a good business to invest in must be one that is relatively easy to run. This includes thinking about how well something can be operated by anyone who starts it up. It may be easier to go along with a business that focuses less on the specifics and complicated points of running it and more on the general and simple. A business like this might be more confident with regards to what it could potentially do.

The efforts that Warren Buffett has used over the years with regards to being more financially successful have made him one of the world’s most respected people. His work is proof that it can be easy to get different investments to work well when the right strategies and opinions are being used.

BIOGRAPHY

Warren Buffett is a famous American investor who’s worth over 100 billion dollars. He attributes his ability to accumulate so much wealth to his mentor and Columbia College Professor, Benjamin Graham. Warren claims that Graham’s books, The Intelligent Investor and Security Analysis, are the primary sources of learning that he continues to reference even today. Buffett’s the third wealthiest person in the world. He’s the owner and CEO of Berkshire Hathaway and he has pledged to give away 99 percent of his wealth to charity upon death.

While it is true that Warren Buffett has become a very successful investor in today’s society, he has actually invested in many things throughout his life. His desire to be an investor started in childhood. That desire has never truly gone away at any point in his life.

Born in Omaha in 1930, Buffett was the son of a member of the United States House of Representatives. He worked at a grocery store run by one of his relatives for a good period of time. He even sold assorted products as a door to door salesman.

He used some of the money that he earned to fund a bank account. He also used some of his money to buy different items that he could invest in with the intention of earning money. One of the most notable examples came from how he bought a pinball machine to place in a public spot in town. He eventually used the money from that venture to buy more pinball machines to place in more spots so he could earn even more money.

In fact, Buffett even invested in shares while growing up. He bought three shares in Cities Services Preferred when he was eleven. He had a minor profit in his investment but sold his shares before they experienced massive price increases.

It is estimated that he had earned about five thousand dollars from his work when he graduated from high school. He did not have an interest in going to college but he did anyway, spending two years at the University of Pennsylvania’s Wharton Business School and then two years at the University of Nebraska at Lincoln.

Part of his education came from a major influence in his life. This influence came from Ben Graham, a prominent investor who created the concept of intrinsic business value. This refers to how the real worth of a business is often separate from the stock value that comes with it. His belief was that intrinsic value could be used to guide decisions in investments rather than stock numbers. This was a critical point of Buffett’s development in terms of how he was able to get into so many different investments after a while.

Buffett went to the Columbia Business School after graduating from Nebraska. He went to Columbia after hearing that Graham taught there. Interestingly enough, this came not too long after Buffett had tried to get into the Harvard Business School. He was rejected from Harvard because admissions assumed he was too young to attend it.

Buffett had studied many of Graham’s works including the Intelligent Investor, a book that Buffett continues to herald to this day as a book that was critical to his education as an investor. It includes one of the most important analogies that Buffett continues to follow to this very day in his investments.

Part of this education from Graham included his support of a value about investing that Graham introduced in this book. His Mr. Market analogy states that stock quotes are simply quotes given out by a business partner that is often going to keep on trying to sell stock and will keep on doing so until the point where that stock ends up being lower in value than what was originally offered or what the business in question might actually be worth.

The final part of Buffett’s education came from a visit with Lormier Davidson, the financial vice president of Geico in the late 1940s. Buffett went to the Geico offices in the hopes of meeting Graham because he was the chairman of that company at the time. However, Graham was not there but Buffett was able to talk with Davidson for several hours about business practices, how to find a profitable group and what a company should do in order to be more successful. This is a critical part of Buffett’s education. Ironically enough, Geico would be a part of Buffett’s business career thanks to how he bought out that company.

Buffett and Graham

The business career of Warren Buffett started out relatively small in the early 1950s but this was primarily from Buffett’s lesson in patience with investing after his early experience with Cities Services Preferred. He started out by buying a small Sinclair Texaco station in the area while he was working as a night class professor at the University of Nebraska in Omaha. He did not make any money off of his Sinclair Texaco investment. He eventually received a call from Graham asking if he was interested in working for him. He eventually got into a partnership with Graham. However, Buffett had some differences between him and Graham. Buffett was more interested in seeing how a company manages itself and how it might be better than other companies when thinking about who to invest in. This is different from the emphasis on numbers that Graham had been using.

Buffett’s money would eventually grow while working alongside Graham. It got to the point where Buffett had made more than $100,000 from 1950 to 1956. This was much higher than the nearly $10,000 that he had at the start of that time. The amount of time Buffett spent with Graham was relatively limited though. Graham tended to focus on hiring Jewish people who were not being taken in by organizations that were Gentile-based. This prompted Buffett, who is not Jewish, to go elsewhere.

How Buffett Became a Millionaire

Buffett created Buffett Associates, Ltd. in 1956. He did this with a few other partners with his sister and aunt being among those people who got in on it. The group was dedicated to work towards investing in shares with businesses in a responsible manner. He was able to get a few partnerships with some businesses during this time and eventually got to where he had nearly $300,000 in capital around the end of that year. The partnership of Buffett Associates, Ltd. helped make Buffett a millionaire in 1962. Nearly a million dollars of the $7 million that the partnership had came out of his money.

Berkshire Hathaway

It would not be long until Buffett bought Berkshire Hathaway, a textile company. He also met Charlie Munger around this time. Munger was a lawyer who eventually focused on investments and has become a quick friend of Buffett. Today Munger continues to work alongside Buffett at Berkshire Hathaway.

Buffett’s first private business investment came in 1966. He invested in a department store in the Baltimore area. Buffett continues to invest in varying stocks and commodities. His efforts with Berkshire Hathaway eventually became more noticeable among investors to the point where times when he would end up investing in something were often signs that something of use was more interesting and potentially more likely to be profitable over time. It eventually got to the point where Buffett had a net worth of a little over half a billion dollars by the end of the 1970s.

However, Buffett was not always successful in his business career. One example involves how he lost a good deal of money in his investment of the Buffalo Evening News newspaper. This came from an antitrust case that was started by that paper’s rival, the Buffalo Courier-Express. However, Buffett continues to hold ownership in the Buffalo News. In this interview, Warren Buffett also shared some of his investing mistakes.

There was also the concern about a market correction in 1987. This caused nearly a quarter of Buffett’s value to be wiped out. However, he rebounded in 1988 by buying up shares of Coca-Cola. He eventually got to the point where the shares that he owned would be close to a billion dollars in value.

How Buffett Became a Billionaire

In 1990 Berkshire Hathaway started to sell class A shares. The shares were around $7,000 each at the time, thus helping to get Buffett to technically become a billionaire. Buffett had a very minimal increase in his assets in 1999, thus leading people to fear that he was losing his touch and that he could be a victim of his own investments. However, he focused on intrinsic value and invested in businesses that were selling shares below their intrinsic values. This helped him to keep on moving ahead and to avoid the pains that came with the technology bubble bursting around that time.

He had invested in a series of banks in recent years. He has spent some money on Wells Fargo and has experienced very mixed results with Goldman Sachs and Bank of America. His results in his investments have involved some losses due to the financial crisis that have harmed the banking industry over the last couple of years.

Today Warren Buffett has gotten to where his Berkshire Hathaway company has revenues of about $140 billion a year. Berkshire Hathaway owns a number of notable companies. The companies that Buffett is an owner of include Benjamin Moore, Dairy Queen, Fruit of the Loom, Geico, Helzburg Diamonds, the Omaha World-Herald, Shaw Industries and Wesco Financial Corporation.

Buffett also continues to hold strong minority holdings in many notable businesses. He has a little less than ten percent of ownership in Coca-Cola. He has been involved with the company since the later part of the 1980s. Buffett also owns close to fifteen percent of American Express, M&T Bank and the Washington Post Company. Buffett most recently acquired a five percent stake in IBM in 2012.

Buffett’s influence has even gone so far as to impact discussions on taxes in the United States. This includes his concern about how he and other people who are rich tend to pay less of their money in taxes than people who don’t make as much money.

He currently has a net worth of about $91.6 billion. This makes him second to Bill Gates among the richest people in the world. In fact, Buffett has been working towards helping to support varying charitable organizations over the years with him donating many of his stocks to the Bill and Melinda Gates Foundation.

The opinions that Warren Buffett holds are interesting to find. They involve the ways how he feels about investing in a variety of different things. These include the ways how investments are to be handled and how different stock has to be used carefully to make it a little easier to run an investment plan the right way to potentially earn the most out of it.

Patience is a Virtue

Patience is often seen as a valuable point for Buffett to teach to people who want to invest like him. This includes observing the history of a business and considering its value to society and whether or not it is a business that may be viable to people in the future. It is used to make sure that an investor is aware of what can go on in society before ending up changing an investment. Of course, most of this could come from the experience that he had with Cities Service Preferred.

What Makes a Business Wonderful

Buffett also uses several criteria for finding the right businesses to use. These are referred to as “wonderful businesses” because they are businesses that might be more profitable and beneficial for people.

A key point that Buffett uses when finding “wonderful businesses” involves seeing how much of a return on capital is involved without any debt in mind. A business that has a smaller amount of debt on it is often seen as one that could be more successful over time.

There is also the interest in seeing how well earnings might work. Buffett feels that the best businesses are the ones that have earnings that are relatively predictable. Businesses like this might be safe but at the same time they may be used to help with figuring out what one might be able to get out of an investment.

One of the best parts of Buffett’s opinions on investing relates to how well businesses can run. He feels that the best businesses to invest in are the ones that are productive and meaningful to society. They should be companies that are actively making some kind of value to society that people can appreciate in. A business like this can be one that might be more active and more likely to be successful as it gets more involved with society in general.

Importance of Cash Flow

Another part of his investing strategies involves how he buys companies. He feels that cash flow streams have to be used carefully when finding investments. A business with a strong cash flow can be one that might be more interesting to invest in. In fact, cash flow streams are often used to determine whether or not he should go ahead with buying entire companies. This opinion of investing shows that he has a strong attachment to finding businesses that might be more profitable before actually buying those companies outright.

While it is true that the assets that Buffett has gotten into are diverse, he feels that diversification of a portfolio is not something that is always going to work out right. The problem with diversification is that it might involve trying to find businesses in random fields. The key is to focus on appropriate cash flows and beneficial investments even if this means finding options that are not always going to be very diverse in nature.

Forecasting and Predictability

One interesting opinion that Buffett has is that getting in on initial public offerings is never a good idea. This is due to how it might be too unpredictable to see how well an IPO is going to work. Buffett prefers to go along with investments that have proven themselves to be of some use in recent years.

Buffett also tries to avoid investing in online and social media companies. Although he does respect these companies, his opinion on investing in these companies is that it is too difficult for people to figure out whether or not stocks in this field will have decent values in the future. The lack of predictability and the lack of knowing how to forecast this point has been a part of the problem according to Buffett.

Buffett is not interested in investing in gold either. While he has gotten into other commodities in the past, he has plans to stay out of the gold picture for the foreseeable future. He feels that the gold industry is not something that is very productive.

Investing in an Easy-to-Run Business

Finally, Warren Buffett feels that a good business to invest in must be one that is relatively easy to run. This includes thinking about how well something can be operated by anyone who starts it up. It may be easier to go along with a business that focuses less on the specifics and complicated points of running it and more on the general and simple. A business like this might be more confident with regards to what it could potentially do.

The efforts that Warren Buffett has used over the years with regards to being more financially successful have made him one of the world’s most respected people. His work is proof that it can be easy to get different investments to work well when the right strategies and opinions are being used.